10 Tax Moves for 2024

Here’s how changes to tax rules could affect you this year.

Key takeaways

2024 could be a good time to start planning for the sunsetting of the Tax Cuts and Jobs Act in 2025.

New rules stemming from the SECURE Act 2.0 have an impact on catch-up contributions for older workers and RMD start dates from workplace plans.

Changes affecting inherited IRAs go into effect this year that could determine what you do with assets in these accounts.

If you made residential improvements to save energy, consider claiming tax credits.

As we head into the spring, now might be the time to think about important changes that could affect your tax planning this year and next. That’s especially the case since it’s an election year and changes to tax rules are sure to be widely debated.

While Congress isn’t evaluating a comprehensive tax package immediately, numerous questions remain about existing cuts related to the Tax Cuts and Jobs Act (TCJA) of 2017. Many sections of the TCJA sunset at the end of 2025, but before the end of the year Congress will need to resolve uncertainties about expiring provisions. Among these are reductions to federal tax brackets, as well as the fate of the increased standard deduction, the state and local tax (SALT) deduction, which was capped at $10,000, and caps on the mortgage interest deduction.

Other changes this year stem from the SECURE Act and the SECURE Act 2.0 and will affect things like catchup contributions for older workers, and the start of RMDs from workplace plans. Additionally, if you’ve inherited an IRA there are new limits on how long assets can remain in tax-deferred status as the stretch IRA is phased out.

“This is a good year to take stock of positive changes from SECURE 2.0, like the increase of IRA catchup limits and the ability to roll unused 529 funds into a Roth IRA," says Jillian Enoch, retirement and tax policy director at Fidelity.

While there may be uncertainty about taxes due to the election, budget deficits, and sunsetting of tax cuts ahead, here are some things to do this year to help reduce your taxes in 2024 and beyond.

1. Capital gains and dividends

The TCJA lowered taxes on long-term capital gains by setting up separate income brackets for assets held longer than 1 year and for qualifying dividends, though the rates remained the same at 0%, 15%, and 20%. (It also retained the 3.8% net investment income tax, or NIIT, for higher income people.)

Whether these rates and brackets will remain the same or increase after the TCJA expires at the end of 2025 is an open question. Potentially higher capital gains taxes in future years mean you may want to consider if it makes sense to realize gains in taxable accounts before a possible increase. Or if you expect losses next year, you might consider waiting until future years when you could possibly benefit from offsetting capital gains when they could be taxed at potentially higher rates.

There are 2 important exceptions. Assets held in tax-advantaged accounts such as a workplace savings plan or traditional IRA are not subject to capital gains taxes, though you do owe income taxes on withdrawals. Additionally, short-term capital gains rates, for assets held less than 1 year are the same as ordinary income rates.

2. Changes to the Child Tax Credit (CTC)

If you have dependent children, a potentially larger Child Tax Credit could mean more money in your pocket.

This federal support program for Americans raising children lets you lower your tax bill by claiming the credit of up to $2,000 per qualifying child under age 17 in your care.

Proposed changes to the CTC are part of a tax bill still before Congress that could expand eligibility and the amount of the CTC. They could also increase the amount eligible for a refund. These changes could be effective retroactively for the 2023 tax year.

3. Tax breaks for older retirement savers

Beginning in the 2024 tax year older workers can plan to put more money away in retirement accounts in future years as the SECURE Act 2.0 increases catch-up contributions to IRAs by indexing them to inflation. While contribution limits to retirement accounts are typically adjusted for inflation every year, catch-up contributions to IRAs in the past haven’t always gotten an annual bump.

Currently, someone age 50 or older can make a catch-up contribution of $1,000 in addition to the standard $7,000 contribution limit in 2024 to an IRA─either traditional, Roth, or some combination of the 2 as long as the combined contributions remain below the limit. Indexing for inflation can help ensure catchup contribution amounts will increase with the cost of living.

Older workers contributing to workplace retirement plans are also affected by SECURE Act 2.0 starting in 2025, when catchup limits will jump to $10,000 annually, or 150% of the regular age 50 catch-up limit, whichever is higher. However, this is only for individuals ages 60 through 63. The increased dollar amount will also be indexed for inflation starting in 2026.

In 2024, individuals can contribute $23,000 to a workplace retirement plan, with a catch-up contribution of $7,500. You might also consider contributions to a workplace Roth, if your plan allows them, because starting in 2024 retirees don’t have to take RMDs from such an account. That can potentially give your savings many more years to grow. Assuming the 5-year aging rule has been met and you’re 59½ or older, withdrawals from a Roth account are also tax-free. Note: If you turned RMD age in 2023 and waited until 2024 to take your first RMD from your Roth 401(k), you will need to withdraw your first RMD from your Roth 401(k), but you will not need to do so thereafter.

That’s a bit different from a traditional workplace plan, such as a 401(k), where savings can accumulate tax-deferred, but RMDs from such an account must begin once you’ve retired and have reached age 73 or more.

4. Changes to inherited IRAs

If you inherited an IRA recently, new regulations go into effect this year that could affect what you do with these assets.

The original Secure Act, passed in 2019, eliminated the so-called “stretch IRA” in favor of a 10-year period before IRAs must be fully distributed, with RMDs potentially being required throughout this period. It also tacked on many other potentially confusing new rules for inherited accounts, but delayed penalties for the failure to take RMDs for tax years 2020 through 2023. Previously, a younger beneficiary of an IRA was able to lengthen the time of an RMD from the deceased or original owner’s life expectancy to their own, allowing potentially for many more years of tax-deferred growth.

Generally speaking, starting in 2024 funds must be distributed within 10 years of the original owner’s death. (The rules did not change for spouses of the original owner as well as for IRA beneficiaries who inherited prior to 2020. Neither is required to empty an account within 10 years.)

A first step might be to understand whether your circumstances require you take distributions from the account within 10 years. For example, if you’re a non-spouse who happens to be close in age to the deceased account owner, you may be able to take RMDs based on your own life expectancy. Additional exceptions may apply for beneficiaries who are disabled, chronically ill, or children younger than age 18, who would be required to take RMDs once they reach the age of majority. Additionally, if an IRA was left to trust, your estate, or charity, the 10-year rule may not apply.

If you are required to begin RMDs within the 10-year period, you may have until the end of the tenth year to empty the account, unless the deceased or original account owner was already taking RMDs in which case a distribution would be required for years 1 through 9 and a complete distribution in year 10. Generally, you might want to avoid taking a lump-sum distribution as it could significantly increase taxable income. As long as the account is empty by year 10, you have some flexibility with the RMD amount. So if your income fluctuates year to year, you could also consider taking withdrawals during years when you know your taxable income will be lower.

Remember, penalties can be steep, equaling 25% of the missed RMD amount. It’s always a good idea to consult with a tax professional to understand how the new rules might affect your own situation.

5. Estate tax reboot

2024 might be the time to start thinking about estate taxes and creating a gifting plan.

Without further legislation in Congress following the sunsetting of the TCJA, the estate tax exclusion will revert to its previous level of $5.6 million from its current level of $12.92 million for single people, adjusted for inflation. No one knows what will happen in Congress in the coming years, but it’s possible that future legislation could reduce the estate tax exemption even further.

Gifting can help reduce the value of your estate without using up your lifetime gift and estate tax exemption. The gift tax exclusion for 2024 increased to $18,000 from $17,000 in 2023. That means you can give up to $18,000 per donor to as many people as you like each year without affecting your lifetime exemption. If you're married and elect to split gifts, each person in the couple can gift this amount without the gift being considered taxable.

You might also consider funding a 529 or custodial account for children in your life. While lifetime contribution limits to 529 accounts are set by states and are often quite high, remember annual contributions over $18,000 will trigger the gift tax. But once inside the account, the money is not considered part of your estate. You can also think about bunching, or front-loading 5 years' worth of annual gifts of up to $18,000 at once in 2024, for a total of up to $90,000 per person, per beneficiary without having to pay gift tax or interfere with the lifetime gift tax exclusion. However, after that, you won’t be able to make gifts under the annual exclusion to the same beneficiary for 5 years. You can also contribute to a custodial account, also known as an UGMA/UTMA account. While such accounts are the property of the beneficiary once you set one up, the assets are considered part of the donor’s estate until the beneficiary is no longer a minor and takes control of them.

Donations to a qualified charity can also potentially lower the value of your estate while helping your tax planning in the year you’re donating. For example, if you itemize you can contribute to a donor-advised fund (DAF) and receive an income tax deduction. When you die, federal law allows for unlimited deductions of contributions to qualified charities. You can also donate highly appreciated assets held longer than a year and deduct the fair market value without having to pay the capital gains tax. Note: If the goal is to avoid capital gains, your beneficiaries could receive a step-up in basis upon inheriting the assets.

Deducting charitable contributions may be subject to adjusted gross income (AGI) limits depending on the receiving charity and what you donated.

6. Reporting of digital assets

Rules involving cryptocurrency and other digital assets are still evolving, and transactions involving them may affect your tax planning this year. If you’re a freelancer, sole proprietor, or small-business owner and you’ve received $10,000 or more in cryptocurrency in a single transaction, you may soon need to report the transaction to the Department of the Treasury on Form 8300. This would make the reporting of digital assets somewhat similar to cash for such transactions, where under the Bank Secrecy Act, cash transactions of $10,000 or more must similarly be reported to avoid attempts at money laundering and tax evasion.

The rule, which is part of the Infrastructure Investments and Jobs Act of 2021, was slated to go into effect on January 1, 2024 but has been paused pending further guidance from the Treasury and the IRS. Nevertheless, you must still report payment, gifts, and other transactions involving digital currency, non-fungible tokens, and stable coins on your Form 1040, 1040-NR, or 1040-SR.

Be sure to work with a tax planner who can help you stay on top of regulatory changes.

7. Claim tax credits and other financial incentives for residential energy improvements

While clean energy residential credits embedded in the Inflation Reduction Act (IRA) of 2022 extend beyond 2024, you may want to act now to claim them as Congress considered rescinding many green credits and incentives during debt-limit negotiations last spring.

The IRA had numerous provisions aimed at transitioning the economy to clean energy, including residential energy credits that fall generally into 2 categories. The first, for creating an energy efficient home, allows for a tax credit up to 30% of the cost for improved doors, windows, water heaters, and energy audits up to an annual limit of $1,200 versus a $500 lifetime credit previously. The credit has been extended until 2033. The second, the residential clean energy property credit, allows for a credit equal to 30% of the sum of amounts paid by the taxpayer for certain qualified expenditures, such as for solar panels, geothermal heat, small wind energy, and fuel cells, with no annual limit, according to the IRS. The credit begins to phase out after 2032.

8. Make the most of bigger contribution limits and wider tax brackets

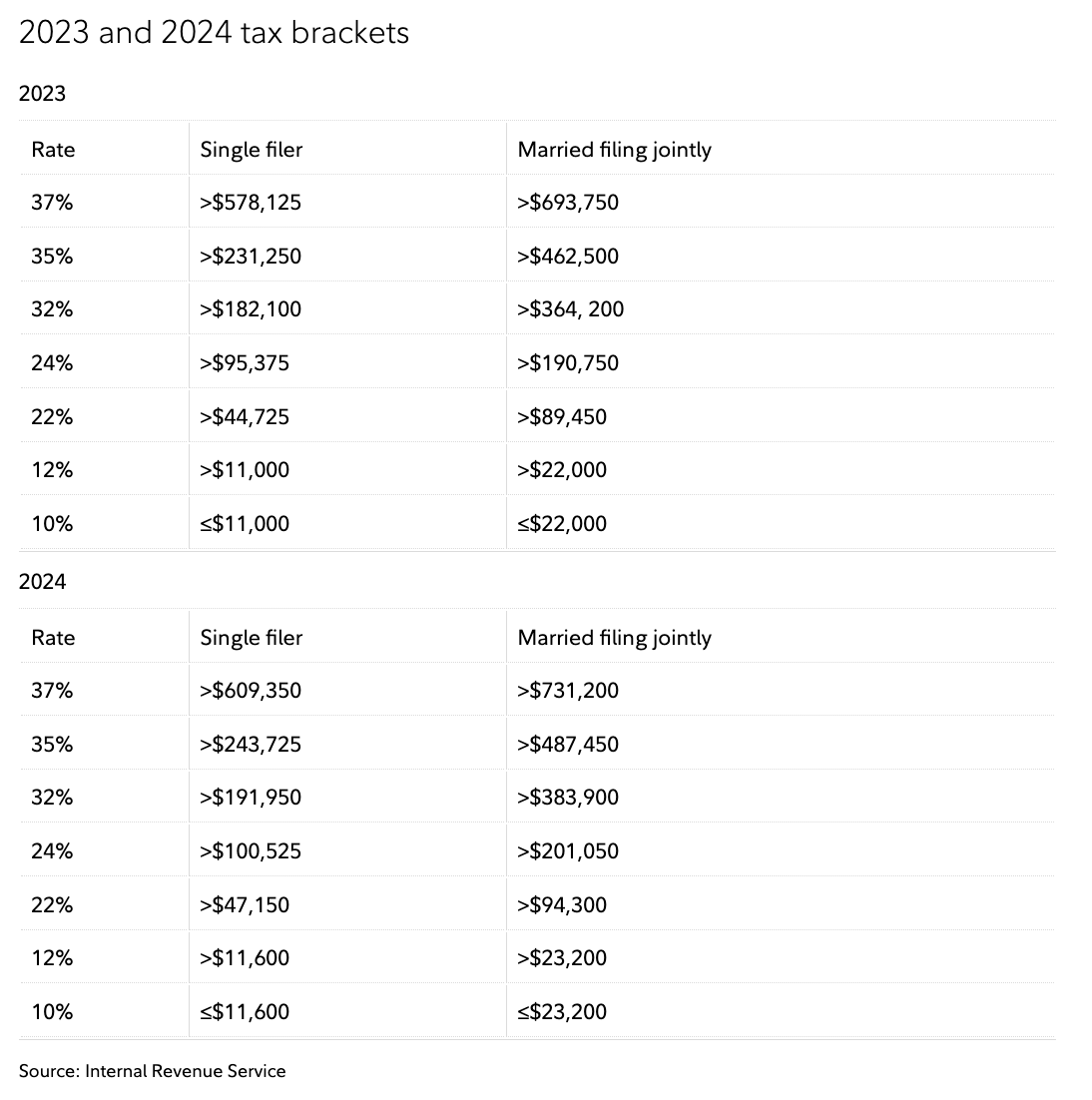

Toward the end of 2023 the IRS increased the income amounts for the 7 tax brackets to account for inflation. It also made inflation adjustments to contributions limits for tax advantaged accounts, such as workplace retirement plans, IRAs, and health savings accounts (HSAs), for those with a high-deductible health plan.

You can avoid a phenomenon called tax bracket bulge—where wage growth and a bigger paycheck meant to combat inflation can also push you into a higher tax bracket—by reducing your taxable income dollar-for-dollar with yearly contributions to your 401(k), HSA, IRA, and other retirement accounts.

In 2024, you can contribute up to $23,000 pre-tax to a 401(k) and up to $7,000 to traditional and Roth IRAs combined. (People age 50 and over can make catch-up contributions of $7,500 to a 401(k) and $1,000 to an IRA.)

For HSAs, an individual with self-only coverage can contribute $4,150 and for those with family coverage, the contribution limit increased to $8,300, with $1,000 more in catch-up contributions for those 55 and over. If both spouses are covered by a family high deductible health plan and share an HSA, they are eligible for one catch-up contribution of $1,000 if one of them is 55 or older and not enrolled in Medicare. If both are 55 or older and both are not enrolled in Medicare, however, and they each want to make a catch-up contribution, they must do so in separate HSAs, resulting in a $10,300 limit. Note: The aggregate amount spouses may contribute to separate accounts is $8,300.

9. 529 rollovers to a Roth

Starting in 2024, 529 account holders can transfer up to a lifetime limit of $35,000 to a Roth IRA established for a 529 designated beneficiary. Conversions are tax- and penalty-free, although a number of important conditions apply. Among them, the 529 account must be maintained for the 529 designated beneficiary for at least 15 years, the transfer amount must come from contributions made to the 529 account at least 5 years prior to the 529-to-Roth IRA transfer date, and transfers are subject to annual Roth IRA contribution limits. For 2024 a 529 beneficiary owner may transfer up to $7,000 annually for the next 5 years to reach the $35,000 lifetime maximum. Unlike regular Roth contributions, which have modified adjusted gross income limitations, 529-to-Roth IRA transfers do not appear to be subject to this limitation at this time. The IRS has not issued guidance on the 529-to-Roth IRA provision in the Secure 2.0 Act but is anticipated to do so in the future. Based on forthcoming guidance, it may be necessary to change or modify some 529-to-Roth IRA transfer requirements.1

10. Free tax filing?

You may be eligible to electronically file your 2023 taxes this year using a pilot program from the IRS, called Direct File, aimed at making tax filing easier and cheaper. The program reportedly walks users through a step-by-step process for filing a return, and lets customers talk via chat to an IRS agent. The program is free.

However, you must be a resident of one these 12 states to participate:

Arizona

California

Florida

Massachusetts

New Hampshire

New York

Nevada

South Dakota

Tennessee

Texas

Washington

Wyoming

The states participating either have no income tax or have the capability to develop a state filing solution, according to the IRS.

To qualify you must have W-2 income or income from Social Security, unemployment, or interest income and plan to take the standard deduction, not itemize, among other qualifications. The program is separate from Free File, another free filing option from the IRS run by numerous tax preparation partners.

Everyone’s tax situation is different, and you may want to consult with a tax professional who can help you understand whether tax changes in 2024 affect your personal circumstances. But armed with information about these changes, you can take steps toward maximizing your tax situation now and in the years to come.