6 Ways to Give Your Kids a Financial Head Start

Start early to set your kids on the path to financial independence. With options like Roth IRAs, HSAs, 529s, and custodial accounts, parents can teach the value of saving, investing, and planning, helping the next generation build lasting wealth.

Key takeaways

Parents and guardians can help their kids grow healthy nest eggs and financial know-how.

Strategically using tax-advantaged accounts can help your family build good habits and long-term financial security.

Helping your teens and adult kids get started saving for their future can give them a tremendous advantage in the future. Here are a few ways you can help them start off on the right foot, in no particular order.

1. HSA opportunities for everyone

Health savings accounts (HSAs) have a couple of features that can help young people supercharge their savings at a young age. Here’s how it works. An HSA offers a triple tax advantage:1 tax-deductible contributions, potential tax-free earnings growth, and tax-free withdrawals for qualified medical expenses.

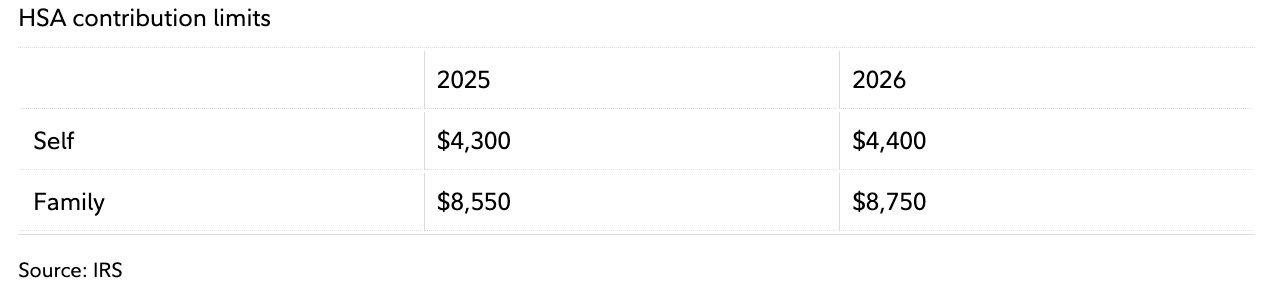

To contribute to an HSA, you need to be enrolled in an HSA-eligible health plan, aka a high-deductible health plan. The IRS sets the contribution amount each year, and it varies based on your health coverage.

Adult children can stay on their parents’ health plan until age 26. But many young people of this age may already be supporting themselves and paying taxes. If you can’t claim your adult child as a dependent on your taxes, you cannot use your HSA to cover their qualified medical expenses.

Good news: The silver lining is that your nondependent child covered by your HSA-eligible health plan can open their own HSA and contribute up to the family limit as well. Anyone can contribute to an HSA on somebody else’s behalf—for instance, parents could make the contribution to their adult child’s account. There are 2 things to know: You can’t use pre-tax deductions from your employer’s payroll to fund your child’s account. You also won’t get a tax deduction for the contribution—your child can claim it, however.

See how HSA balances could grow with time and potential tax savings.

2. Save in a Roth IRA at any age

Starting to save for retirement before starting a career can actually make sense. It’s easy to do with a custodial Roth IRA. If your child of any age has earned income from work, formal or informal, they can contribute to a Roth IRA.2 If your child is under 18, you could consider opening a custodial Roth IRA, called a Roth IRA for Kids at Fidelity. Once your child becomes an adult (the age differs by state), you simply transfer ownership of the account.

Benefits of a Roth IRA. Contributions to a Roth IRA are made on an after-tax basis. Potential earnings can be withdrawn tax-free in retirement as long as some requirements are met.3

Besides retirement, there may be other ways to use the account. For instance, buying a home for the first time may qualify for tax- and penalty-free withdrawals of up to $10,000. And contributions can be withdrawn any time, without taxes or penalties.

3. Don’t snooze on 529s and 529 to Roth IRA rollovers

Helping kids transition into the adult world without debt is a common priority for parents. One tax-advantaged way to do that is with a 529 savings plan. 529 savings plans are flexible, tax-advantaged accounts designed specifically for education savings. They can be used to pay for qualified education expenses, expenses for K–12 schools up to $10,000 ($20,000 beginning in taxable years after December 31, 2025), apprenticeship costs, vocational schools, and student loan repayments ($10,000 lifetime limit).4

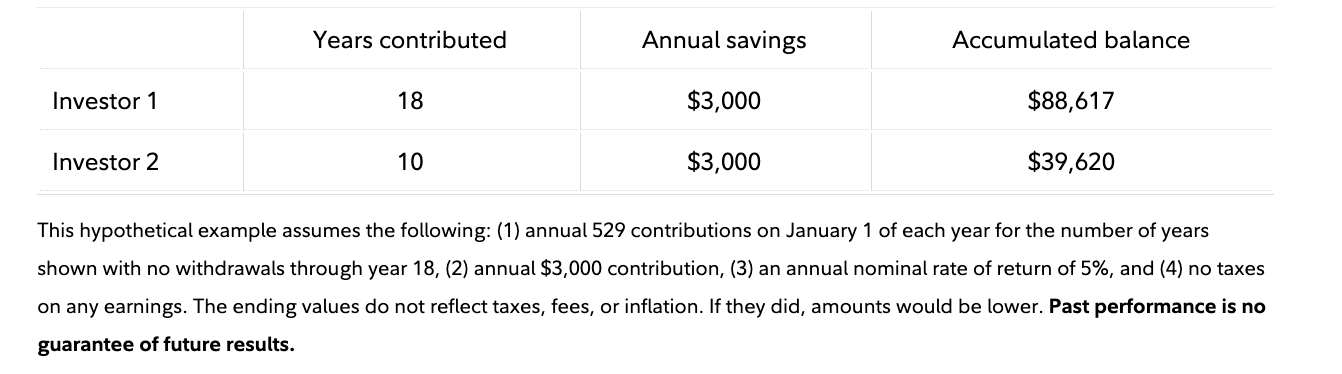

But time is potentially money when saving for a child’s education. Starting early gives your money plenty of time for growth potential when you invest your savings.

Starting early makes a difference

Investor 1 starts saving and investing $3,000 annually in a 529 when their child is born.

Investor 2 starts saving and investing $3,000 annually in a 529 when their child is 10 years old. To end up with as much as Investor 1, Investor 2 would need to save about $6,700 a year.

Contributions to a 529 are made after-tax, and earnings can be withdrawn tax- and penalty-free when used for qualified education purposes.4 While there is no tax deduction at the federal level for contributions, some states do let you deduct contributions to 529 plans from your income subject to state income tax.

When not used for qualified education expenses, withdrawals of earnings are subject to a 10% penalty and taxes. Contributions are made with after-tax money and are not penalized if withdrawn. Read Fidelity Viewpoints: The ABCs of 529 savings plans

The prospect of potentially being penalized for not using all the money in the account may have given some parents pause before committing to a 529. But keep the following in mind:

The beneficiary on the account can be changed to a family member of the original beneficiary.

Under certain conditions you may be eligible to roll over assets from your 529 to a Roth IRA established for the beneficiary of the 529 account.5

The law now allows for up to a lifetime limit of $35,000 to be transferred to a Roth IRA—the transfers are subject to the annual Roth IRA contribution limit. However, there are several things to consider before going ahead with such a transfer:

The 529 plan must have been maintained for the designated beneficiary for at least 15 years. (Separately, the Roth IRA also must be established in the name of the designated beneficiary of the 529 account.)

The amount transferred from a 529 account to a Roth IRA in the applicable year, together with all other IRA contributions for the tax year for the same beneficiary, must not exceed the Roth IRA annual contribution limit applicable to the beneficiary.

Additionally, the transfer amount must come from contributions made to the 529 account at least 5 years prior to the transfer date and the aggregate amounts transferred from 529 accounts to all Roth IRAs must not exceed $35,000 per beneficiary.

Please consult a qualified financial or tax professional regarding your specific circumstances before making any investment decision. You may have a gain or loss when you transfer your 529 assets.

Read Fidelity Viewpoints: How unused 529 assets can help with retirement planning

4. Building credit

A great credit score can be surprisingly helpful in life. It affects more than the cost to borrow. Everything from insurance rates to apartment rentals may be decided by your credit score.

Adding your teen or young adult child to your credit card as an authorized user can be a great way to help build credit. At Fidelity, your child needs to be 13 or older to be added as an authorized user to Fidelity’s credit card. The authorized user is not responsible for the bill and may not make any changes to the account—but the available credit will be reported to all major credit bureaus.

There’s just one important thing to remember—your authorized user will get a card in their name but only you will be responsible for making the payment. The good news is that you do get to reap the rewards of any spending by your authorized user if you’re using a rewards or cashback card, like the Fidelity® Rewards Visa Signature® card.

5. Build strong money skills with Fidelity Youth® Account

Learning to save and invest for short- and long-term goals is one of the most important money skills to master. Teens can benefit by getting in the driver’s seat with their money.

One way to do that could be with the Fidelity Youth Account. It’s a teen-owned brokerage account that lets teens age 13 and older invest on their own, with the supervision of a parent or guardian.

Helping kids build good habits early can help them reap the potential rewards of investing and long-term financial security.

6. Consider custodial accounts for children’s money

A custodial account can be opened on behalf of a minor to invest money they are gifted, earn, or inherit. Any adult (parent, relative, guardian, friend) can open a custodial account for the benefit of a child. Money put into the account must be used for the child's benefit, and when they reach the age of majority (typically 18 or 21 depending on the state) they gain full legal control over the assets.

Custodial accounts generally have the acronyms UGMA/UTMA associated with them. These accounts are taxable brokerage accounts with no contribution limits. A portion of any custodial account earnings are tax-advantaged. (Kiddie tax rules may apply—in tax years 2025 and 2026, $1,350 of a child's earnings may be exempt from federal income tax. Additionally, for earnings that exceed the exemption amount, another $1,350 may be taxed at the child's tax rate, which is generally lower than the parent's tax rate.) Read Fidelity Viewpoints: What to know about the kiddie tax

One of the biggest bonuses is flexibility: Custodial accounts can be used for anything that benefits the child.

Set the next generation up for success

Small steps can lead to big results over time. Parents can help set their kids up for success in the future by modeling good behavior and getting kids involved. Consider talking about the value of saving and investing and offering opportunities to help your child learn to manage money before adult responsibilities take over. Fidelity Learn even has a section for young people that can help: Personal finance for students