Four Factors Behind Bitcoin’s Recent Volatility

Crypto markets have pulled back sharply since October, with bitcoin down over 30% from its peak. Rather than one trigger, a mix of higher real rates, unwinding leverage, whale rebalancing, and fading optimism is driving volatility, while long-term fundamentals remain intact.

KEY TAKEAWAYS:

Since mid-October, cryptoassets have experienced a sharp pullback - but there’s not one discrete catalyst behind the volatility

In our view, a combination of factors including the Fed’s outlook, unwinding leverage, reduction of outsized positions, and unwinding optimism has all played a role

When looking towards what comes next, it’s important to remember bitcoin’s longer term role in a portfolio as a non-sovereign, decentralized global asset with a finite supply

TODAY’S CRYPTO MARKETS

Over the past few weeks, bitcoin and the longer tail of crypto assets have experienced a sharp pullback, materially outpacing more modest corrections seen in broader markets.

After reaching its all-time high of $126K in early October, bitcoin fell as low as $84k or ~33%.1 The recent price action cannot be attributed to a single headline event or catalyst. Instead, in our view, it reflects a confluence of loosely connected factors and evolving market structure dynamics:

Shift in Fed Outlook: Expectations for slower Fed rate cuts have pushed real yields higher. For context, in October the market was pricing in a ~30% chance of one rate cut or fewer. As of early December, markets are pricing about a 46% chance of one rate cut or fewer by the March 2026 Fed meeting.2 While bitcoin’s fundamentals are largely detached from traditional economic drivers or country-specific risks, bitcoin has historically shown sensitivity to USD real rates, similar to gold and emerging-market currencies. The latest dip, on Nov. 30, occurred during a low-liquidity holiday weekend evening in the U.S.

Unwind of Excessive Leverage: Heavy use of leveraged perpetual futures in cryptoasset trading amplified short-term speculation and appears to have precipitated a “flash crash” on Oct. 10, when an initial price drop triggered automated forced liquidation of long positions, adding substantial selling pressure and setting off a chain effect that ultimately erased over 30% of futures open interest3. Lingering aftereffects of this leverage-driven sell-off persist, contributing to an overhang in the market.

Whales Rebalancing: For a substantial cohort of long-time bitcoin holders (many with cost bases of <$1k, “Whales”), $100K represented a key psychological milestone and implicit portfolio rebalancing trigger. We observe that crossing this threshold prompted some investors with concentrated exposure begin reducing overly concentrated bitcoin positions, thereby adding incremental selling pressure to the market.

Unwind of Digital Asset Treasury Optimism: Shares of digital asset treasury companies (DATs) have sold off sharply QTD and now predominantly trade near or below the NAV of the bitcoin holdings. The large premiums that spurred a flurry of new listings earlier this year have vanished, removing a source of buying pressure and raising questions of whether some treasury companies will conduct asset sales to bring their share prices back to NAV.

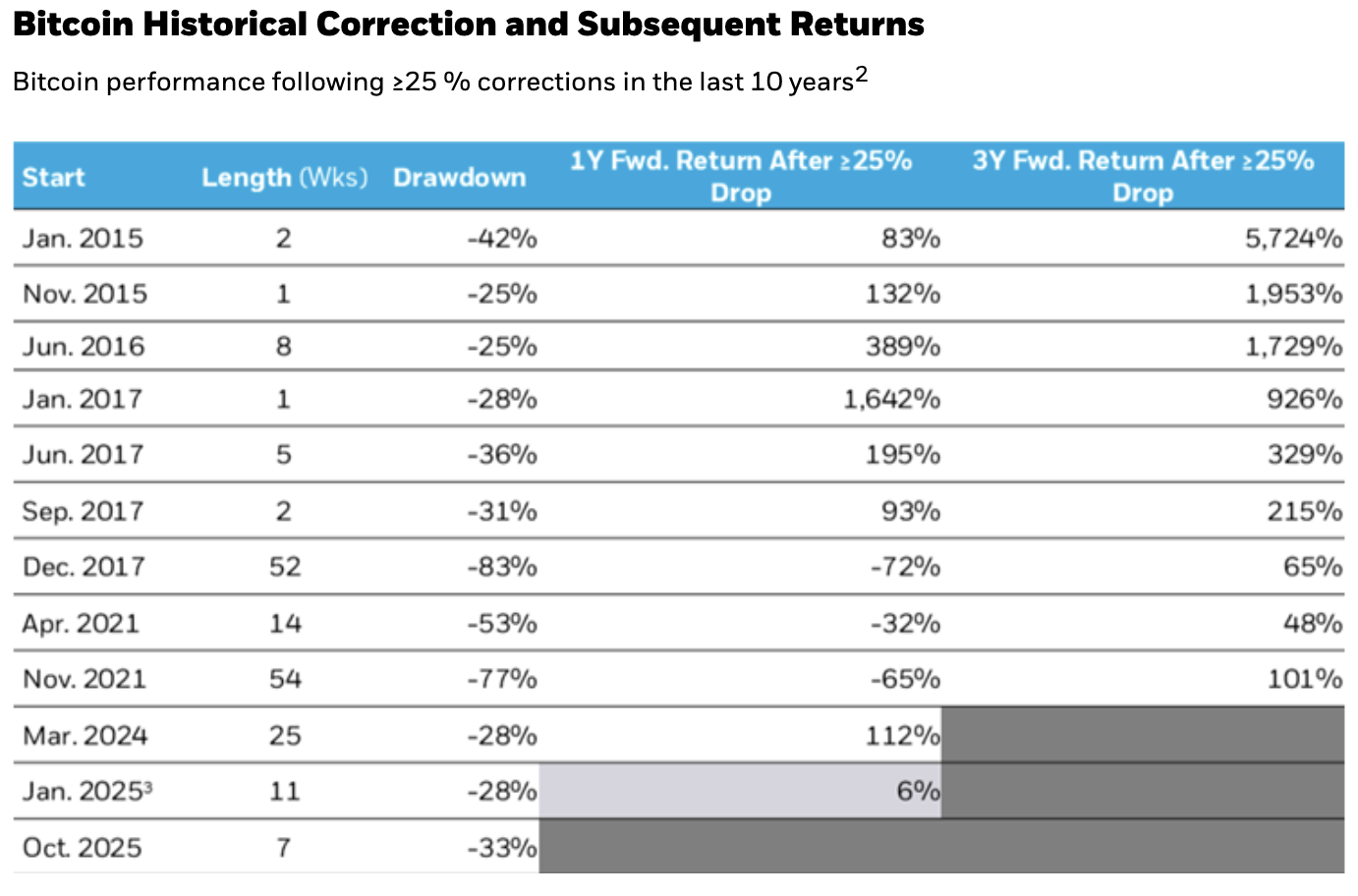

* 1Y forward period only partially complete, as of Nov. 30, 2025

Source: Bloomberg Bitcoin Spot Price and BlackRock calculations, as of Nov. 30, 2025. Measured from the date at which the drawdown first breached 25%. Length measured from peak to trough in weeks. Spot price performance does not represent actual Fund performance. Past performance does not guarantee future results.

THE PATH FORWARD

What does all of this mean for investors considering an allocation to bitcoin? While short-term direction is difficult to predict, drawdowns have historically provided attractive long-term entry points. Market corrections tend to curb excesses, with recent liquidations removing significant leverage from the crypto ecosystem, bringing speculative positioning back to more sustainable levels.

Looking ahead, we believe bitcoin’s long-term fundamental drivers appear intact – institutional adoption, regulatory maturation, and rising global concerns around sovereign debt levels and geopolitical fragmentation continue to support bitcoin’s investment case.

In our view, the path forward in 2026 is likely to be driven in large part by liquidity conditions in the U.S. and other major economies - i.e., the pace of rate cuts – and by the trajectory of Institutional and Wealth Advisory adoption, which has trended steadily upward since the U.S. bitcoin ETPs first launched in January 2024.

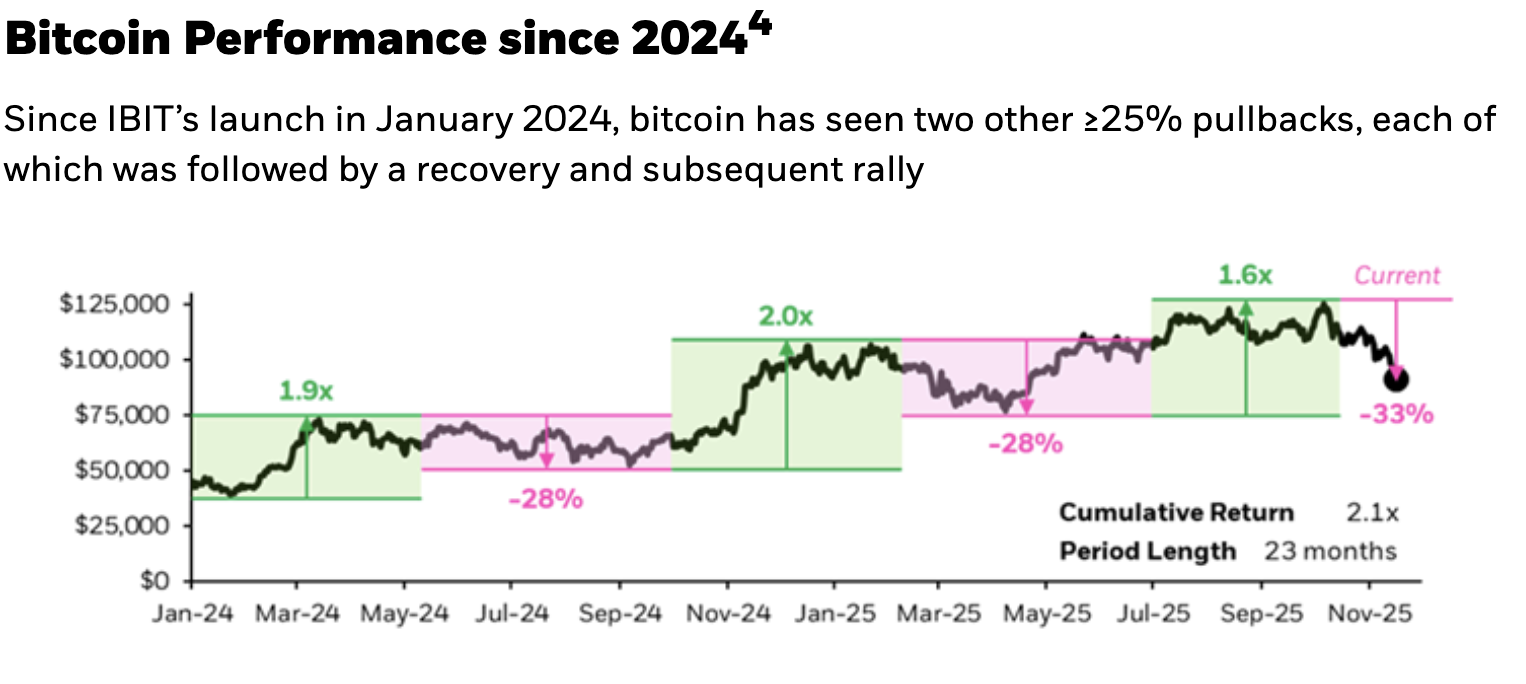

As always with bitcoin and crypto, a volatile journey is likely to be part of the equation, in either direction, we have seen two other drawdowns greater than 25% since the launch of the iShares Bitcoin Trust ETF (IBIT), and following each of the drawdowns was a strong recovery reaching new highs.

The iShares Bitcoin Trust ETF is not an investment company registered under the Investment Company Act of 1940, and therefore is not subject to the same regulatory requirements as mutual funds or ETFs registered under the Investment Company Act of 1940.

Source: Bloomberg Bitcoin Spot Price and BlackRock calculations, as of Nov. 30, 2025. The iShares Bitcoin Trust ETF (IBIT) launched on January 5, 2024. Spot price performance does not reflect actual Fund performance. Past performance does not guarantee future results.

BITCOIN IN YOUR PORTFOLIO

In times of volatility, it’s important to take a step back and remember the role that bitcoin exposure can play in a portfolio. Bitcoin’s nature as a fixed supply, non-sovereign, decentralized global asset has caused some investors to consider it as an option in times of fear and around certain geopolitically disruptive events.