Sometimes It Helps to Pay Less Attention

While market swings and tariff headlines grab attention, sometimes the best response is to tune them out. Focusing on long-term trends rather than daily movements reveals a smoother, steadier climb, reminding investors that patience often outperforms reaction.

I was on holiday during the stock market’s recent ups and downs and missed out on the media coverage and the surrounding “will they/won’t they” China tariff news. That is actually my preferred way of coping with market volatility, which is to be unaware of it in real time. While I don’t always have a built-in buffer,1 there’s certainly an argument for tuning out daily market movements.

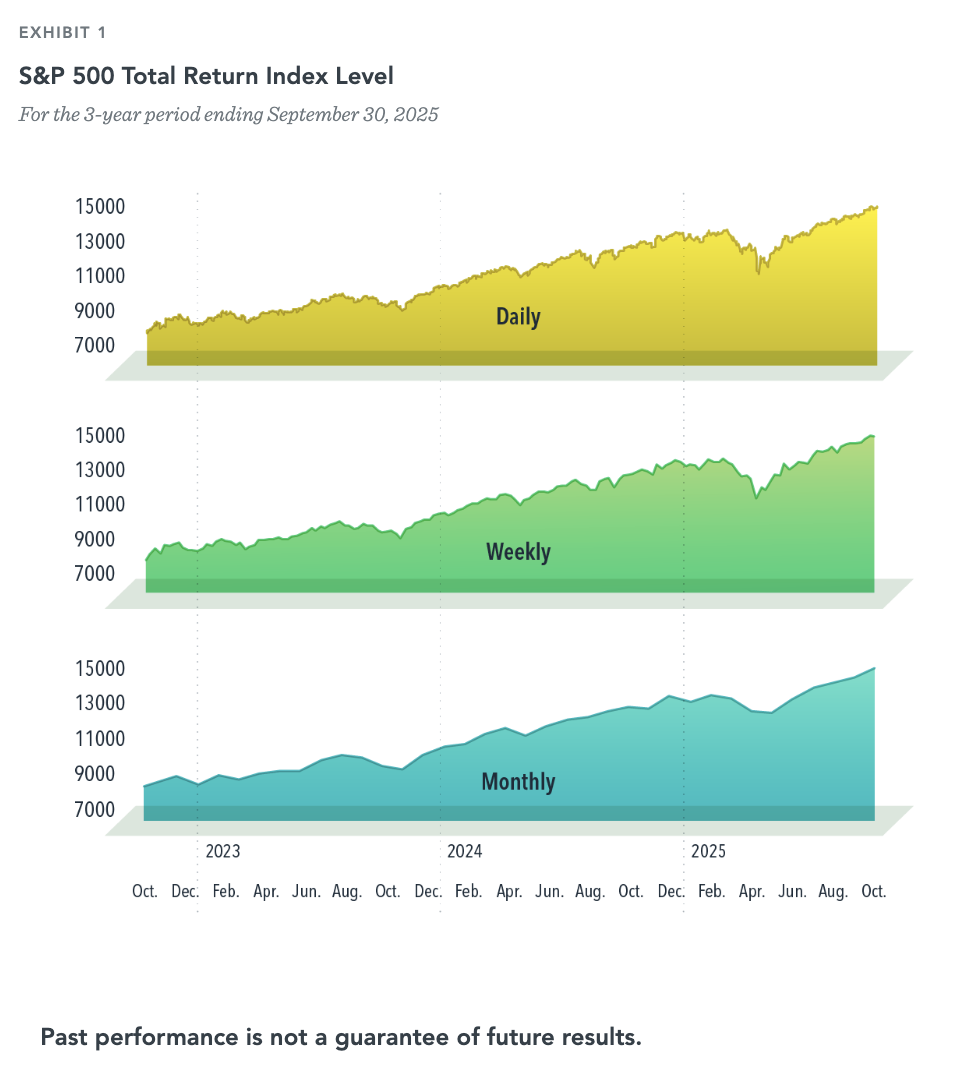

The benefit of the ignorance-is-bliss approach can be visualized by plotting out returns at longer time intervals. As you switch from daily returns to weekly, the jagged edges begin to smooth out. By the time you get to monthly returns, some of the big drawdowns (e.g., third quarter of 2023, April 2025) seem like small blips during an otherwise continuous climb.

A desire to stay informed about what’s going on in the world is human nature, and developments with the stock market are part and parcel of that. But thinking about investments in a long-term framework might dull the temptation to make asset allocation changes that studies have shown are a recipe for disappointment.

Disclosures

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.