The Power of Human Ingenuity

Markets rise not because predictions are right, but because people innovate, adapt, and persevere. David Booth argues that investing is a long-term bet on human ingenuity—and history shows it's a powerful one.

By David Booth, Executive Chairman and Founder

Exhibit 1: Human Ingenuity Powers the Market

Investing in the market means investing in people, their ideas, and their innovations

It’s an unstoppable optimism that leads to innovation. Human ingenuity powers the market—the many thousands of companies around the world, employing millions of people, each finding new ways to move us forward. The stock market provides the best mechanism I know of to process information, set fair prices, and allow investors to benefit from society’s collective endeavors.

The year 2020 was a particularly striking example of this. As COVID spread around the world, stocks crashed, with the S&P 500 falling 34% in less than five weeks. But businesses got to work: on treating the virus, serving people stuck at home, and eventually finding a vaccine. By the end of December the S&P 500 had recovered its losses and then some, up 18% for 2020, showing that markets can rise even through times of global distress.

Exhibit 2: Red Alert

Many observers foresaw a negative year for stocks in 2024. But companies innovated, businesses launched new products, and markets defied predictions.

Last year served as a reminder, too. 2024 came against a backdrop of geopolitical tensions, economic uncertainty, and electoral anxiety in the US and elsewhere. Those concerns accompanied stubbornly high inflation, a shift in direction for interest rates, and the ripple effects from conflicts in Ukraine and the Middle East. Some observers speculated this could be the beginning of a prolonged economic downturn, worries that were reflected in predictions by many market watchers.

Despite bearish market forecasts for 2024, in the US, the S&P 500 returned a robust 25.0%. Alongside the gains in the US, the global stock market, as measured by the MSCI All Country World Index, was up 20.3%. Even bonds, after struggling earlier in the decade, delivered solid returns (4.2% as measured by the Bloomberg Global Aggregate Bond Index). Taken together, it was a reminder that markets can be hard to predict. Even when uncertainty abounds, markets price in expectations of future cash flows, driven by people and businesses that are constantly seeking to overcome challenges and create opportunities. Investors with broadly diversified portfolios who stuck with their plans were rewarded for their patience and discipline.

Exhibit 3: Perseverance over Predictions

Equity analyst predictions vs. actual S&P 500 Index calendar-year price returns.

Past performance is not a guarantee of future results.

By owning a broad slice of global markets, we can participate in the upside of human problem-solving and innovation.

There are always plenty of surprises and fluctuations along the way. Individual stocks and sectors go up and down based on current events, earnings reports, and shifting consumer sentiment. But zoom out and the big picture becomes clear: Over the past century, the US stock market has consistently risen, returning on average about 10% a year.1 This is why I have unwavering faith in markets. By owning a broad slice of global markets, we can participate in the upside of human problem-solving and innovation as it takes place across a vast array of companies and the untold number of ideas their employees develop.

Whatever the difficulties, people find ways to adapt, create, and move forward. Markets reflect this reality, and investors harness the power of markets by staying disciplined, diversifying globally, minimizing costs, balancing risks, and pursuing higher expected returns. Those are timeless principles that don’t depend on predictions or guesswork—they simply allow everyone to participate in the rewards of human creativity and resilience.

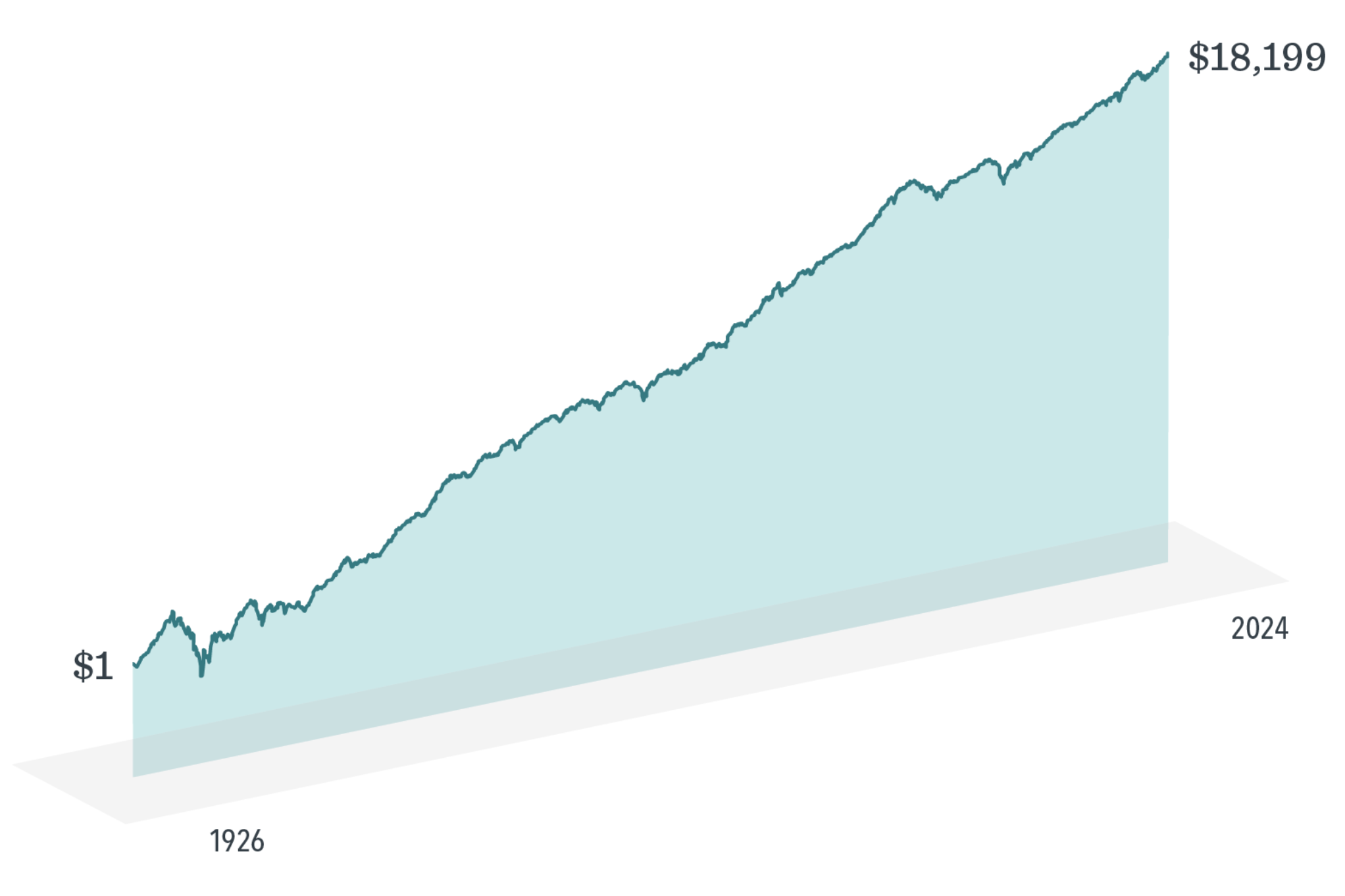

Exhibit 4: March of Progress

S&P 500 Index (1926–2024)

Past performance is not a guarantee of future results.

Human ingenuity powers the market—the many thousands of companies around the world, employing millions of people, each finding new ways to move us forward.

It’s also worth remembering that true wealth is about more than the balance in your investment account. It’s about having the financial security and peace of mind to be able to focus on what matters most—your health, your relationships, your passions and purpose. It’s about living a life of meaning and optimism, even when we’re unsure about what lies ahead. And it’s about trusting in the power of human ingenuity.

As we look forward, let’s carry these lessons with us. Let’s continue to invest in markets and in ourselves. Let’s have faith in progress, even if the path isn’t always smooth. Throughout history, we’ve faced countless challenges, yet we’ve always found a way to adjust and overcome. We’ve harnessed the power of technology, unlocked the secrets of science, and created societies that are more prosperous and more connected than ever before. And I believe this trend will continue. I believe in our ability to confront any obstacle as we build a better future. As long as people keep dreaming and solving problems, opportunities to grow and develop will be abundant—for ourselves and for generations to come.