Will the U.S. Run Out of Funding After Reaching the Debt Ceiling?

For investors, we anticipate a slowdown in economic growth and inflation should bring bond yields down, but debt ceiling risks, although certainly not our base case, could derail the bond market recovery and foment significant volatility if realized.

UPDATE: This post was updated on January 23 to reflect official estimates published by the U.S. Treasury Department.

On January 19, the U.S. reached the debt ceiling, or debt limit, of USD 31.381 trillion, which is the cap on how much money the federal government is authorized to borrow to meet its obligations. However, this does not automatically trigger a default on U.S. debt. The U.S. Treasury can still use funds from the Treasury General Account (TGA), the federal government’s operational account at the Federal Reserve, and it can implement “extraordinary measures” to continue to meet its obligations. Through these mechanisms, Treasury Secretary Janet Yellen expects to finance obligations until early June, although the risk of miscalculating that timing is high depending on the monthly budget deficit.

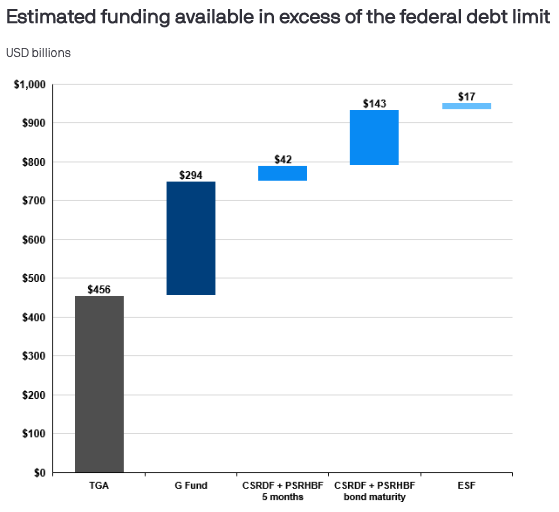

The first additional source of funding is the Treasury General Account, which stood at USD 456 billion on January 19. Second, the “extraordinary measures” being considered are: (1) redeeming existing/suspending new investments into the Civil Service Retirement and Disability Fund (CSRDF) and the Postal Service Retiree Health Benefits Fund (PSRHBF), (2) suspending reinvestment of the Government Securities Investment Fund (G Fund), (3) suspending reinvestment of the Exchange Stabilization Fund (ESF), and (4) suspending sales of State and Local Government Treasury securities. This would make the following funds available:

USD 8.4 billion per month from the CSRDF and the PSRHBF

USD 294 billion from the G Fund

USD 17 billion from the ESF

USD 143 billion from an annual bond maturity and interest payment to the CSRDF and PSRHBF on June 30

Together, the available TGA balance and extraordinary measures could provide over USD 950 billion in available funds to meet government obligations through June. We estimate available funding could be sufficient through August given our monthly deficit estimates. However, our deficit estimates are highly uncertain given the challenges of estimating spring tax receipts since COVID. Therefore, there is still a risk that these sources of funding could be exhausted before Congress acts.

Although lawmakers typically wait until the last minute on the debt limit, they usually do come to a resolution. Congress has raised or suspended the debt ceiling 79 times since 1960. While Congress is likely to do the same this time around, the threat posed is whether they get the timing right. If they do not, the consequences of default would be severe: spiking bond yields, higher borrowing costs, plunging consumer confidence, and financial market turmoil and contagion.

For investors, we anticipate a slowdown in economic growth and inflation should bring bond yields lower, but debt ceiling risks, although certainly not our base case, could derail the bond market recovery and foment significant volatility if realized.

Source: U.S. Treasury, J.P. Morgan Asset Management. Treasury General Account (TGA), Government Securities Investment Fund of Federal Employees Retirement System Thrift Savings Plan (G Fund), Exchange Stabilization Fund (ESF), Civil Service Retirement and Disability Fund (CSRDF), Postal Service Retiree Health Benefits Fund (PSRHBF). Data are as of January 19, 2023.