The New Capital JOURNAL

Financial news, views, advice, and guidance.

Brought to you by New Capital and our business partners.

Which Country Will Outperform? Here’s Why It Shouldn’t Matter.

Investment opportunities exist all around the globe, but the randomness of global stock returns makes it exceedingly difficult to figure out which markets are likely to be outperformers.

People Have Memories. Markets Don’t.

Prices change based on what’s happening right now and what people think will happen in the future.

2022 Year End Market Review

Watch a recording of our webinar: Year End Market Review presented by Leonard Golub, CFA.

2022 Annual & Q4 Market Review

The DFA 2022 Annual and Q4 Market Reviews feature world capital market performance and a timeline of events for the past year and the past quarter.

This Has Been a Test: Developing a Financial Plan You Can Stick With

What has stayed constant throughout my life is the power of people to make progress in the face of challenges.

Time the Market at Your Peril

My fear is that faster and easier ways of investing will allow people to lose more money faster and easier.

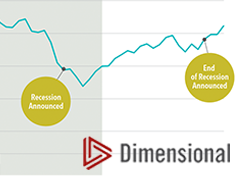

Markets Don’t Wait for Official Announcements

Some investors may worry about the stock market sinking after a recession is officially announced. But history shows that markets incorporate expectations ahead of economic reports.

Trust the Financial Advisor Who Trusts the Market

With over 200,000 financial advisors in the United States, how do you pick one?

Quarterly Market Review - Q3 2022

The DFA Quarterly Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

How to Invest Better—and Live Better

Connecting life principles to investment principles is a powerful way to ground abstract principles in reality, and to connect over universal experiences and feelings.

Wes Crill on Global Diversification, Market Declines, and Value

The bedrock component of Dimensional’s investment approach is broad diversification, which we think is a great risk control in environments like this.

FAANGs Gone Value

Investors advocating for the superiority of growth firms, such as the FAANGs, are inadvertently making the case for their expected future cash flows to be discounted at a lower level.

Ingenuity and the Investor

Investors are often tempted to focus their attention on firms that appear poised to benefit from innovation. But it’s difficult to predict which ideas will prove successful, and even if we could, it’s unclear which firms will benefit and to what extent.

The Difference Between a Forecast, a Wish, and a Worry

When it comes to investing, it’s crucial to remember the difference between news and opinion, and how they are sometimes used to forecast the future.

Making Cash Flows Count

This article discusses the systematic and important ways in which Dimensional Fund Advisors manages cash flows in and out of mutual funds held by New Capital’s clients.

Quarterly Market Review

The DFA Quarterly Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

Chasing High-Flying Stocks Risks Meme Reversion

The potentially smoother journey that diversification offers may be less entertaining on the way up, but it generally makes for a better experience than leaving investment goals to chance.

Are We Headed for a Recession?

Just two years removed from the last US recession, negative stock returns and aggressive US Federal Reserve interest rate hikes have many investors concerned we are headed for another big “R”—if we’re not already there.

Light at the End of the Inflation Tunnel?

It seems some investors have resigned themselves to a new normal of high inflation. However, financial market data tells a different story.

History Shows That Stock Gains Can Add Up after Big Declines

A broad market index tracking data since 1926 in the US shows that stocks have tended to deliver positive returns over one-year, three-year, and fve-year periods following steep declines.