The New Capital JOURNAL

Financial news, views, advice, and guidance.

Brought to you by New Capital and our business partners.

Video: Stay On Top of Your Financial Life

Access your finances anytime, anywhere with the RightCapital portal and mobile app.

Video: Benefits of a Tax Efficient Distribution Strategy

Learn how a Tax Efficient Distribution Strategy can help your financial future.

Video: Change Your Financial Future Today

A brief overlook of Right Capital’s services and benefits. Are you ready to change your financial future?

New Capital Adds Insurance Advisory Services

Working with our new partner DPL Financial Partners, an insurance "back office" provider, we are now able to provide detailed analysis of existing policies, and present and implement new term life insurance, permanent life insurance, variable annuity contracts, and other instruments.

Federal Student Loan Interest Rates Decrease for 2019-2020

For the first time in three years, interest rates on federal student loans will decrease for the 2019-2020 academic year. The lower rates apply to new federal student loans made on or after July 1, 2019, through June 30, 2020.

Webinar Invitation: Mid Year Update on Portfolio Performance - July 11th

Stocks have rebounded in the first half of 2019, and bonds have rallied as well. Still, concerns and fears remain prevalent in the market, value and international stocks have under-performed, inflation is quiet, and the yield curve has turned negative. Register now!

New eSignature Service for Fidelity Money Transfers

Fidelity now offers eSignature service for money movement transactions through DocuSign.

New IRS Guidance on State and Local Tax Refunds

If you received a federal tax benefit from deducting state and local taxes as an itemized deduction in a prior taxable year and you recover all or a portion of those taxes in the current taxable year, you may need to include a portion of the recovery in gross income.

Portfolio & Market Review: May 2019

The strong market rally of 2019 came to a screeching halt in May as investors dealt with renewed worries of an escalating trade war between the US and China.

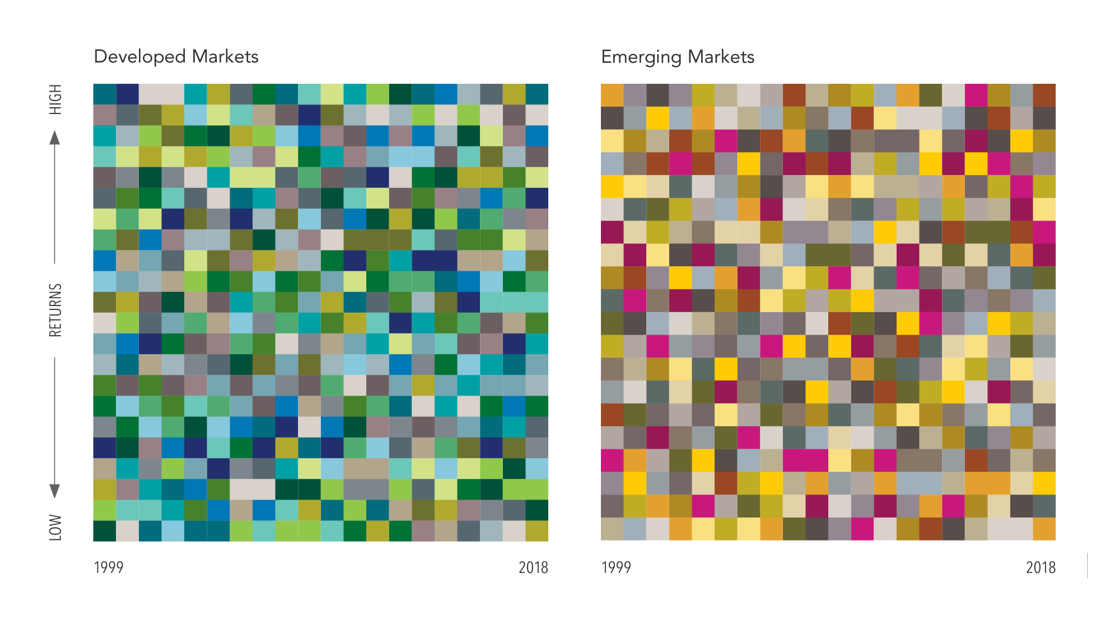

The Randomness of Global Equity Returns

Across more than 40 countries, there are over 15,000 publicly traded companies. If you listen to the news, however, some countries may seem like better places to invest than others based on how their economies and stock markets are doing at the time

U.S.-China Trade War: Who Pays the Price?

The fundamental issue is the imbalance in this relationship; the goods and services trade deficit of $379 billion represented more than 60% of the total U.S. trade deficit. For years, U.S. officials have accused China of using unfair trade practices to maintain this imbalance, even as China has grown into a global economic powerhouse.

Retirement Confidence Increases for Workers and Retirees

Two-thirds of U.S. workers (67%) are confident in their ability to live comfortably throughout their retirement years (up from 64% in 2018). Worker confidence now matches levels reported in 2007 — before the 2008 financial crisis.

Portfolio & Market Review: April 2019

The month of April was a continuation of the strong market momentum we have experienced since the start of the year.

How to Help Your Clients Choose the Right 401(k) Plan

Okay, so maybe your client has asked you if they should offer a 401(k). Or maybe you’ve suggested that they offer one. Either way, do you really know how to help them pick the right plan? There are lots of variables to consider, so you’ll want to be familiar with all the angles.

A New Era of Workplace Communications: Will You Lead Or Be Left Behind?

As companies look to institute new strategies for business communications, team messaging and collaboration applications are increasingly becoming important elements of a broader strategy.

1040 Postmortem: Making Sense of Your Taxes and Withholding

The Tax Cuts and Jobs Act (TCJA), which passed in December 2017, made fundamental changes to the U.S. tax code, and 2018 returns were the first time most taxpayers could see the practical impact of these changes.

The Future of Social Security and Medicare: Here's What Trustees Are Projecting

The newest reports, released on April 22, 2019, discuss the current financial condition and ongoing financial challenges that both programs face, and project a Social Security cost-of-living adjustment (COLA) for 2020.

Hedging for Different Market Scenarios

More investors are considering broadening their approach to diversifying equity risk to include strategies such as long duration bonds, managed futures, alternative risk premia, and tail risk hedging. However, it’s important for investors to know in what types of environments each strategy is more likely to work and in what environments each are likely to be less effective.

The Uncommon Average

The US stock market has delivered an average annual return of around 10% since 1926. But short-term results may vary, and in any given period stock returns can be positive, negative, or flat.